Business Energy

How can a factory reduce its energy consumption?

29 Jun 2022

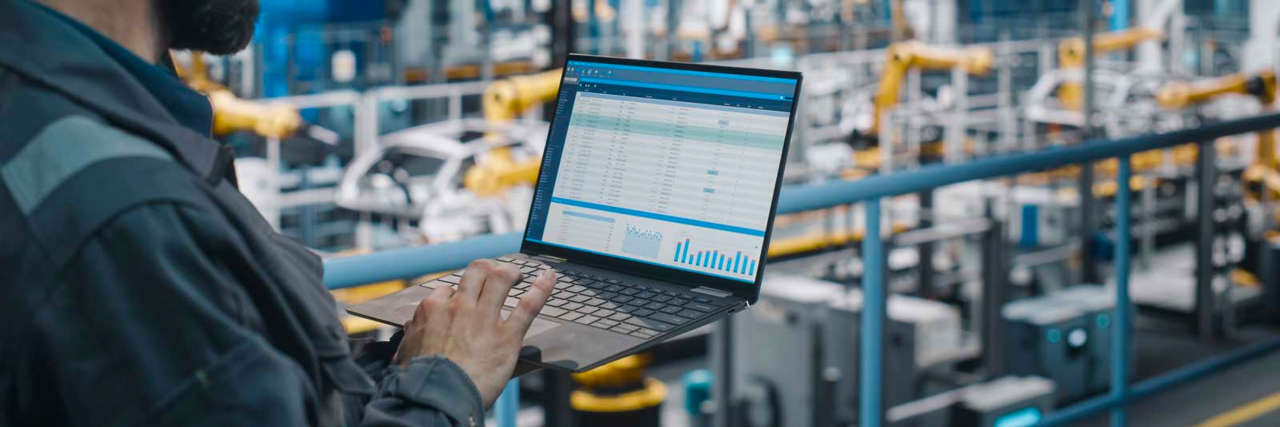

With energy prices continuing to rise, factory owners consider undertaking a comprehensive energy audit to understand where, how and when to make the critical changes necessary to reduce their energy consumption.

How can a factory reduce its energy consumption?

Natural gas is pouring into Britain's LNG import terminals, leading to a sharp reduction in gas prices for the UK's industrial sectors. This might sound like good news for businesses struggling with high energy bills. However, energy suppliers must buy gas on long-term contracts, and industrial energy costs are considerably higher than commercial businesses. Add to this that Britain's storage capacity is light compared to the United States or other European countries. Take the Netherlands; despite being a sixth of our size, they have more than nine times our capacity for natural gas.

While we cannot control the current energy market, there are measures a factory can take to manage its consumption better.

How to conduct a commercial energy audit?

You might think that the amount of energy a factory consumes via heating, ventilating, and lighting is fixed. Yet cost savings of up to 30 per cent are achievable, with an initial energy audit to inform your strategy.

To improve energy efficiency and reduce wasted energy, you should understand how your factory uses energy. Here are seven tips for conducting an energy audit.

Find air leaks. The best way to detect leaks is to use an ultrasonic acoustic detector. This can identify the high-frequency hissing sounds that come from air leaks. These portable units have microphones, amps, audio filters, and visual indicators or earphones to detect leaks.

Verify insulation levels. The lower the quality of insulation, the higher the chance of energy loss. You will need to check the thickness of the exterior wall insulation by shining a flashlight into an outlet box. If your building has an attic, you're advised to ensure your insulation is above the attic floor joists.

Check your thermostat. Heating and cooling can be responsible for a large proportion of your building's energy bill. A workspace that's too cold in the summer or too hot in the winter not only wastes energy but is also bad for morale, as workers are less productive. Turning your thermostat up or down by just a couple of degrees can reduce wasted energy usage. A smart thermostat can help your factory manage temperatures by turning the heat and air conditioning down during idle times. It will also allow you to have better energy management during peak hours.

Inspect the HVAC system. Along with your thermostat, ensure you perform the recommended maintenance on your HVAC unit. This could mean changing the filters once every three months and having a technician service it once a year.

Reduce air compressor energy usage. Identify idle periods when the compressor can be shut down and identify leaks with ultrasonic leak detection technology. Like an open balloon, the pressure builds up when the compressed air is deliberately released. This energy is harnessed to power various pneumatic tools.

Consult with Carbon Trust. Carbon Trust advises businesses on strategy, risks and opportunities, target-setting, carbon reduction plans and transitioning to a low carbon factory.

Financing your energy audit

If your business doesn't have the equipment necessary to make an energy audit, equipment financing could provide your business with the funds to purchase (or lease) said equipment. You can lease almost anything, from gas detectors to industrial-grade air conditioning units. An equipment loan can help you improve cash flow and meet ongoing business expenses.

Get equipment financeGreen finance to cover energy costs

Another option for businesses is to go directly to their energy supplier, as Ofgem have recently shared. Some suppliers in the UK are now able to offer specific financial support to small business owners to help reduce their energy consumption.

If you're a business looking for funding from a lender who follows sustainable practices, we'll match your needs to our panel of vetted green lenders.

Get green financeWhy compare business energy quotes?

The average small business spends over £3,500 a year on energy. If you can cut that by 10%, that's a significant saving and an excellent target. Start saving today by comparing the best business energy deals in the market and switching to a cheaper tariff in minutes.

See your business energy optionsAcquisition Finance

Check your eligibility with our online form without affecting your credit score.

Get acquisition financeSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.