News

Spring Statement 2022: How will it impact businesses and households?

23 Mar 2022

Amid the huge economic implications of the war in Ukraine and with inflation at its highest in three decades, Chancellor Rishi Sunak's Spring Statement included a number of new measures designed to support homes and businesses. Find out what’s new:

The chancellor had hoped to move to a single budget this year, and use the Spring Statement on 23 March as a means to update the nation on economic forecasts and tax change ideas.

But with inflation at a 30-year high and the cost of living continuing to soar, the Government announced measures intended to help ease the burden on households and businesses. The measures include:

1. National Insurance threshold raised

From July 2022, the government will raise the threshold for the amount people earn before national Insurance to £12,570 a year. "That’s a £6bn personal tax cut for 30 million people across the United Kingdom” and “a tax cut for employees worth over £330 a year."

2. 0% VAT on energy-saving materials

For the next five years, homeowners will pay 0% VAT on energy saving materials such as solar panels or heat pumps.

If you’re looking to invest in green technologies for your business, you could be eligible for green business finance. You can use it to fund green assets like electric vehicles and solar panels, green projects, and sustainable products and services.

Get green finance3. 5p fuel duty cut

Fuel duty is cut by 5p, which the chancellor says is "the biggest cut to all fuel duty rates ever". The cut will apply from 6pm tonight and last until March 2023. The RAC says cutting fuel duty by 5p will take £3.30 off the cost of filling a typical 55-litre family car.

4. Support for Ukraine

“We have a moral responsibility to use our economic strength to support Ukraine” including “to impose severe costs on Putin’s regime”, said Sunak.

The government is supplying military aid to help Ukraine defend its borders and approximately £400m in economic and humanitarian aid - as well as up to $0.5bn in multilateral financial guarantees. The new ‘Homes for Ukraine’ scheme will help ensure “those forced to flee have a route to safety here in the UK.”

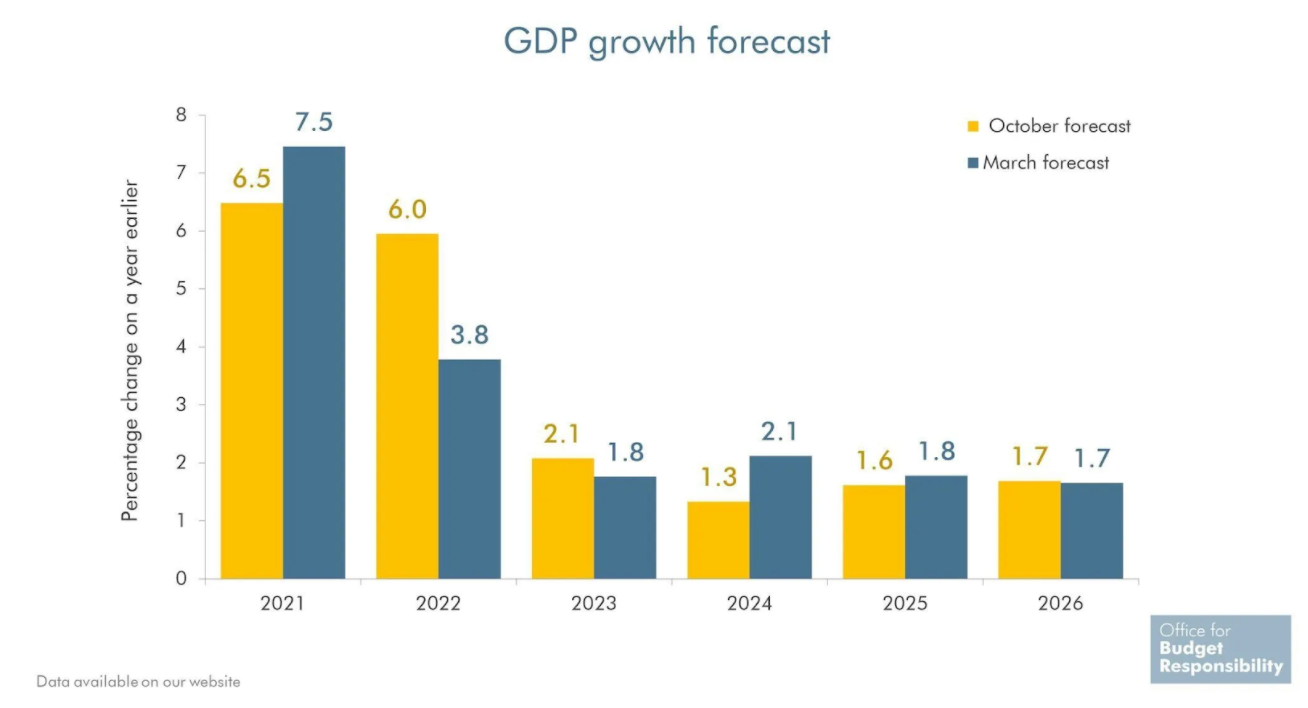

The OBR cut its forecasts for economic growth this year due to the Russia-Ukraine war leading to a spike in inflation.

5. Employment allowance rise

In two week’ time the Employment Allowance, which allows eligible employers to reduce their annual National Insurance liability, will increase from £4,000 to £5,000.

6. Basic rate of tax to be cut by 2024

By the end of 2024, OBR expects inflation to be back under control, debt to fall and the economy growing. With this in mind the chancellor says that before the end of this Parliament in 2024, the basic rate of income tax will be cut from 20p to 19p in the pound. "A tax cut for workers, for pensioners, for savers. A £5bn tax cut for over 30 million people."

7. Household support fund doubled

The government's household support fund, designed to help councils support vulnerable households will be doubled to £1bn from April 2022.

8. Tax credits and rates for businesses - to be reviewed

Sunak has pledged that the government will reform the generosity of tax credits on the money private organisations spend on research and development. The government also intends to cut tax rates on business investment.

Details will be set out in the Autumn Budget.

9. Employment and training tax - to be reviewed

Employment training in the private sector is to be reviewed in line with the government's new tax plan. Sunak says this will include assessing whether the apprenticeship levy (the tax on the wage bills of major companies to pay for skills training) is "doing enough".

Additional funding for businesses

If your business requires additional finance to help manage cash flow and meet rising costs, there are lots of options available. If you’ve been impacted by the coronavirus pandemic, you still have until 30 June to apply for a finance facility under the Recovery Loan Scheme (RLS).

There are plenty of other loan facilities to choose from outside of the RLS too.

For example, if you’re experiencing supply chain disruption, you may want to apply for supply chain finance. Or, if you run a retail business and need a quick cash flow boost to purchase stock, hire staff or invest in e-commerce, a merchant cash advance could help.

Whatever your needs, see what your business could be eligible for today.

Apply for financeBusiness Finance

Check your eligibility using our online form without affecting your credit score.

Apply hereSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.